Imagine a digital ecosystem that thinks, verifies value, and settles transactions autonomously—a self-coordinating internet where intelligence, proof, and payment function as one seamless layer. This isn’t science fiction; it’s the converging reality of artificial intelligence, cryptocurrency, and Web3 that will define the technological landscape of 2026 and beyond. The boundaries between these three transformative forces are dissolving, creating unprecedented opportunities for those who understand how to strategically combine AI with crypto and Web3.

In 2026, we move from theoretical potential to practical integration. AI won’t just analyze crypto markets; it will become an active, autonomous participant in decentralized networks. Crypto assets will evolve beyond stores of value to become the lifeblood of AI agent economies. Web3 will mature from a collection of speculative dApps into a trusted infrastructure for a machine-readable and machine-operable world.

Are you wondering how to combine AI with crypto and Web3 to build the next groundbreaking application or make a forward-looking investment? You’re not alone. As we move through 2026, what was once speculative fiction is becoming operational reality. The convergence is no longer a question of “if” but “how,” moving from adjacent technologies to a deeply interwoven infrastructure layer that is quietly transforming industries, workflows, and the very mechanisms of trust . This fusion promises to solve critical challenges: bringing verifiable transparency to opaque AI models, enabling true autonomy for decentralized applications, and creating new economic models where intelligent agents can cooperate and transact independently.

This article is your definitive guide to navigating this shift. We’ll move beyond the hype to provide a clear, actionable framework for combining AI and blockchain technologies. You’ll discover the concrete strategies leading builders are employing, the most promising platforms to watch, and the practical use cases that are generating real value today. By the end, you’ll have a roadmap for how to position your projects, investments, and skills at the forefront of the most significant technological convergence of our time.

The 2026 Convergence: Why AI and Web3 Are Inseparable

The foundational question, “Will AI and crypto work together?” has been decisively answered. They are not just compatible; they are complementary forces solving each other’s core weaknesses. In 2026, we are witnessing the emergence of a self-coordinating internet where AI makes decisions, blockchains verify them, and payments enforce them—all in a seamless, automated flow .

Think of it this way: AI provides the intelligence, while crypto provides the trust and incentives. Centralized AI operates as a “black box”—its decisions are opaque, its data sources can be biased, and it’s controlled by a handful of corporate entities. Web3 introduces a paradigm of decentralized intelligence, where models can be transparent, auditable, and governed by communities rather than monopolies . Conversely, blockchain networks gain a powerful “brain” through AI, enabling them to move beyond simple, pre-programmed smart contracts to dynamic, intelligent systems that can analyze real-time data, predict outcomes, and execute complex strategies autonomously. This synergy is the key to unlocking the next generation of the internet.

The Core Drivers of Convergence

Several key technological and market drivers are accelerating this fusion in 2026:

-

The Need for Verifiable Trust in AI: As AI agents begin to operate autonomously in high-stakes environments like finance and healthcare, there is a critical need for an immutable record of their actions. Blockchain provides this essential “trust mesh,” creating a permanent, auditable log of what happened, when, and why .

-

Demand for Decentralized Model Development: The market is shifting away from massive, general-purpose models controlled by Big Tech toward specialized, community-owned models. Protocols that offer verifiable privacy, data provenance, and domain-specific accuracy are gaining traction, especially in regulated sectors .

-

Infrastructure Maturing for Scale: Modular blockchains and Layer-2 solutions are now providing the tailored, cost-efficient environments necessary for running complex AI models and inference engines without sacrificing decentralization . New chains like 0G are being built specifically as high-throughput data layers for AI, solving previous bottlenecks .

In essence, the fusion answers a critical market need: intelligence that is not only powerful but also accountable, transparent, and accessible.

A Strategic Framework: How to Combine AI and Blockchain

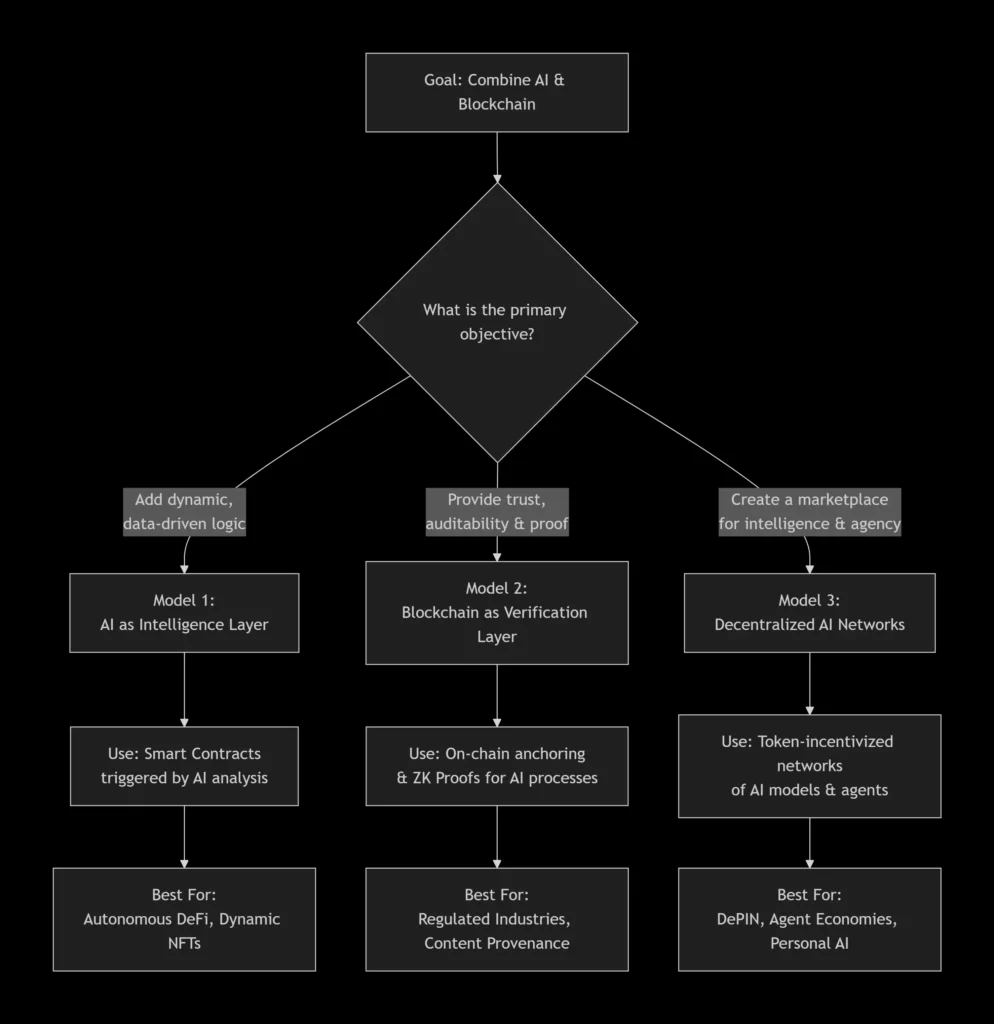

So, how do you combine AI and blockchain in a practical, impactful way? Successful integration in 2026 follows a strategic framework centered on specific architectural patterns. Below is a breakdown of the primary models, their applications, and the leading platforms enabling them.

Model 1: AI as the Intelligence Layer for Smart Contracts

This is one of the most direct methods of integration. Here, smart contracts trigger AI actions based on on-chain conditions, moving beyond static “if-then” logic to dynamic, data-driven execution .

-

How It Works: A smart contract on a blockchain holds funds or governs permissions. An off-chain or zk-verified AI model analyzes real-world data (via oracles) to reach a conclusion. The model’s verifiable output then triggers the smart contract to execute—releasing funds, minting an NFT, or rebalancing a portfolio.

-

Primary Use Cases:

-

Autonomous DeFi & Risk Management: An AI agent can analyze counterparty risk in real-time before a lending protocol releases funds, achieving a 90% reduction in compliance processing time with a near-zero error rate .

-

Dynamic NFT & Gaming Economies: Intelligent NPCs with evolving behaviors or NFTs whose attributes change based on real-world events or player performance.

-

AI-Driven Compliance: Automating KYC/AML checks and regulatory reporting with AI models that learn from new compliance data.

-

Model 2: Blockchain as the Verification Layer for AI

This model uses blockchain’s immutability to create trust in AI processes. It’s crucial for proving that a model used valid data, operated without tampering, or produced a specific output.

-

How It Works: Hashes of training data, model parameters, or inference outputs are anchored on a blockchain. Zero-Knowledge Proofs (ZKPs) are a game-changer here, allowing a model to prove it made a decision using valid inputs and following its rules—without revealing the sensitive data or proprietary logic itself .

-

Primary Use Cases:

-

Provenance for AI-Generated Content: Certifying that an image, article, or piece of music was created by a specific AI model at a certain time.

-

Auditable AI in Regulated Industries: In healthcare or finance, institutions can prove to regulators that their AI diagnostic or trading models are operating within approved guidelines.

-

Fairness and Bias Audits: Providing a tamper-proof record of the data used to train a model, enabling public verification of its fairness.

-

Model 3: Decentralized AI Networks & Agent Economies

This is the emergence of AI-powered decentralized agents that operate within peer-to-peer marketplaces for intelligence. These networks create entire economies around AI.

-

How It Works: Platforms like Bittensor and the Artificial Superintelligence Alliance (Fetch.ai, SingularityNET, Ocean Protocol) create decentralized networks where participants are incentivized with tokens to train, host, or use AI models . AI agents—autonomous programs with wallets—can then hire these models to perform tasks, negotiate with other agents, and transact using micropayments .

-

Primary Use Cases:

-

Decentralized Physical Infrastructure Networks (DePINs): AI optimizes crowd-built networks for wifi, energy, or data storage, predicting maintenance and dynamically allocating resources .

-

Agent-to-Agent Commerce: Imagine a supply chain where an AI agent representing a manufacturer automatically negotiates with an AI agent representing a shipper, with payment settled instantly on-chain upon delivery verification.

-

Personalized AI Assistants: Agents that manage your digital life—from optimizing your DeFi yield across protocols to scheduling meetings—paid for with micro-transactions for each service.

-

To visualize which integration model is best suited for different strategic goals, refer to the following table:

Top Platforms and Projects to Build On in 2026

Choosing the right infrastructure is critical. Here are the leading platforms at the intersection of AI and Web3 that are seeing real adoption and developer activity in 2026 .

| Platform | Category | Core Value Proposition for AI x Web3 | Why It’s Relevant in 2026 |

|---|---|---|---|

| Bittensor (TAO) | Decentralized AI Network | A peer-to-peer marketplace for machine intelligence, organized into specialized “subnets.” | Over 50 active subnets with real on-chain revenue; a true crypto-native approach to incentivizing AI development . |

| Fetch.ai / ASI Alliance | AI Agent Network | Network for building and deploying autonomous economic agents that can interact with both web2 and web3 systems. | Mature agent framework that combines LLMs with decentralized coordination to enable actionable automation, not just conversation . |

| Ocean Protocol | Data & Model Marketplace | Sophisticated platform for tokenizing and privately sharing AI data and models, enabling monetization while preserving privacy. | Focus on verifiable, private data exchange crucial for the next wave of compliant, high-value AI applications . |

| 0G | Modular AI Chain | A high-throughput modular blockchain designed specifically as a data availability and storage layer for on-chain AI applications. | Solves the critical data bottleneck, allowing high-performance AI apps to run fully on-chain; positioned for high growth . |

| Space and Time | Verifiable Compute | Provides cryptographically proven off-chain computation (SQL and AI) that can be trustlessly delivered to smart contracts. | Its “Proof of SQL” and AI verifiability are becoming essential plumbing for enterprises needing verified on-chain analytics . |

| Render Network | Decentralized GPU Compute | A distributed network of GPU power for rendering and, increasingly, AI/ML training and inference workloads. | Successfully scaled to handle massive rendering jobs; now pivoting to be a core compute layer for AI in the creative and simulation sectors . |

Critical Considerations: Security, Privacy, and the Human Element

As we combine AI and crypto, new challenges and priorities emerge that must be addressed head-on.

Enhancing Web3 Security with AI

How do AI agents enhance Web3 security? They shift the paradigm from reactive to predictive. AI-driven threat detection systems can now analyze blockchain transaction patterns, smart contract code, and mempool data in real-time to identify sophisticated phishing attempts, fraudulent smart contracts, and anomalous behavior indicative of an attack . This is becoming a non-negotiable layer of defense as state-sponsored actors and AI-enhanced cyberattacks escalate .

The Privacy Imperative

Privacy is no longer a feature; it’s the most important moat and a prerequisite for mainstream adoption, especially in finance . Technologies like Zero-Knowledge Proofs (ZKPs) and Trusted Execution Environments (TEEs) are critical. They allow AI to operate on sensitive data—for example, assessing a credit risk or diagnosing a medical image—without ever exposing the underlying data to the network, balancing utility with absolute privacy .

From KYC to KYA (Know Your Agent)

A new bottleneck is emerging: agent identity. For an AI agent to open a bank account, sign a contract, or make a large purchase on your behalf, it needs a verifiable identity. The industry is shifting from Know Your Customer to “Know Your Agent,” where agents have cryptographically signed credentials linking them to their owner, their permitted actions, and their liability framework . This is the essential plumbing for the agent economy.

Core Pillars of the Convergence: A Strategic Framework

To successfully combine AI with crypto and Web3, you must understand the symbiotic relationships between several foundational pillars. The framework below outlines the critical components and how they interact to create a powerful, integrated system.

Pillar 1: The Rise of Decentralized AI and Autonomous Agents

The most dynamic trend is the emergence of decentralized AI agents—autonomous programs that can analyze data, execute transactions, and collaborate on-chain. Think of them as your digital employees or partners in the Web3 world.

-

What They Do: These agents can manage DeFi yield farming strategies, execute complex trades based on real-time on-chain and off-chain data, participate in DAO governance, and even negotiate with other agents.

-

The Infrastructure Need: For this to work, we need robust AI crypto infrastructure. This includes protocols like The Graph (GRT), which indexes and serves structured blockchain data to AI models, and decentralized compute networks like Render (RNDR), which provide the GPU power needed for AI inference and training.

-

The Identity Challenge: As noted by a16z crypto partners, a major bottleneck is shifting “from intelligence to identity.” We need a framework for “Know Your Agent” (KYA)—cryptographic credentials that establish an agent’s permissions, ownership, and liability, just as KYC does for humans. Without KYA, the agent economy cannot securely scale.

Pillar 2: Tokenizing AI Assets and Workflows

Cryptocurrency provides the native economic layer for AI in Web3. This goes far beyond AI crypto coins as speculative assets. It’s about creating tokenized economies that align incentives.

-

Incentivizing Contributions: Projects like Bittensor (TAO) create decentralized marketplaces for machine intelligence, where developers are rewarded in TAO tokens for contributing and improving AI models. Similarly, Filecoin (FIL) incentivizes a decentralized storage network crucial for housing the massive datasets required for AI.

-

Monetizing AI Outputs: Platforms like Story Protocol enable the tokenization of AI-generated intellectual property (IP). An AI-created digital artwork, story, or music track can be minted as an NFT, with ownership rights and royalty streams embedded and automatically enforced via smart contracts. This creates a new paradigm for the creator economy.

Pillar 3: On-Chain Intelligence and Verifiable AI

A critical problem with today’s powerful AI is its “black box” nature—its decisions are often opaque and unaccountable. Web3 solves this through transparency and verifiability.

-

Auditable AI: By anchoring AI training data, model versions, and decision logs on a blockchain, we create an immutable audit trail. Companies can prove how a model reached a conclusion, which is vital for regulatory compliance in finance, healthcare, and other sensitive fields.

-

Censorship-Resistant AI Apps: Projects like the Internet Computer (ICP) allow AI models and the applications that use them to be hosted entirely on-chain. This prevents centralized platforms from de-platforming AI services and ensures open, permissionless access to intelligence.

Strategic Action Plan: How to Position Yourself in 2026

Understanding the theory is one thing; taking action is another. Here’s a breakdown of strategic paths based on your role and goals.

For Developers and Builders

Your skills are in extremely high demand. The focus is on building the infrastructure and applications that power the convergence.

-

Master the Stack: Deepen your expertise in AI model integration with smart contract development. Languages like Solidity (Ethereum) and Rust (Solana, NEAR) are essential, coupled with Python for AI/ML. Familiarize yourself with oracle networks (like Chainlink) that feed real-world data to AI agents on-chain.

-

Build for Specific Use Cases: Don’t build generic tools. Identify acute pain points.

-

DeFi x AI: Build intelligent portfolio managers that rebalance assets across protocols autonomously or create risk-assessment agents for lending platforms.

-

Gaming x AI: Develop AI-driven non-player characters (NPCs) with tokenized behavior models or tools that use AI to generate dynamic, ownable in-game assets.

-

-

Leverage Development Partners: If you need to scale quickly, partnering with a top Web3 development company can be a force multiplier. Companies like eSparkBiz and SoluLab specialize in building secure, scalable blockchain solutions with expertise in AI integration, from NFT marketplaces to complex DeFi systems.

For Investors and Traders

The convergence creates a new asset class and novel investment strategies. Move beyond simply buying AI crypto coins.

-

Evaluate the “Tech Stack” Layer: Invest in protocols that provide critical infrastructure. This includes:

-

Decentralized Compute & Storage: Tokens like RNDR (GPU rendering for AI) and FIL (decentralized data storage).

-

Data & Oracle Networks: Tokens like GRT, which powers the data layer for countless dApps and AI agents.

-

AI Agent Platforms: Look at projects like Fetch.ai (FET), now part of the Artificial Superintelligence Alliance, which is building a foundational layer for autonomous agent economies.

-

-

Look for “Revenue-Generating” AI in Web3: Instead of just hype, seek projects where AI is directly generating fees or value on-chain. Is an AI agent managing a treasury? Is an AI model being licensed for use in a dApp? These are signs of sustainable utility.

-

Practice Cautious Speculation: The AI hype is fueling significant token surges. While opportunities abound, conduct thorough due diligence. Look for projects with live products, active developer communities, and clear roadmaps for integrating AI in a way that enhances their core blockchain offering.

For Entrepreneurs and Business Leaders

Your opportunity is to solve real-world problems by applying this converged technology.

-

Enterprise Adoption: Use blockchain for verifiable provenance and smart contracts, and layer in AI for optimization and prediction. For example, tokenize supply chains so every component can be tracked, and use AI to predict delays or optimize logistics in real-time. This is a major trend for 2026.

-

Create New Business Models: Explore Decentralized Physical Infrastructure Networks (DePIN). Build a network where individuals contribute resources (like data from IoT sensors or spare computing power) and are rewarded with tokens. An AI layer can then optimize the allocation of these resources.

-

Focus on User Experience (UX): The mass adoption of AI-powered crypto tools hinges on UX. Work on “invisible” blockchain technology—where the power of smart contracts and AI agents operates seamlessly in the background of a simple, intuitive interface. Innovations in account abstraction for wallets are key here, making blockchain interactions as easy as using a mainstream app.

Navigating Risks and Future Challenges

This convergence is not without its hurdles. A strategic approach requires acknowledging and planning for them.

-

Technical Complexity: Integrating AI with blockchain’s deterministic environment is challenging. AI is probabilistic, while blockchain transactions must be exact. Solutions like verifiable computation and zero-knowledge machine learning (zkML) are emerging to bridge this gap, allowing AI inferences to be proven correct without revealing the underlying data.

-

Regulatory Uncertainty: The regulatory landscape for both crypto and AI is evolving. Projects that proactively engage with compliance—such as those in the Regenerative Finance (ReFi) or institutional DeFi space—and can demonstrate transparent, auditable AI will be better positioned.

-

Security Imperatives: Combining AI and crypto creates new attack vectors. AI models can be manipulated with adversarial data, and smart contracts interacting with AI oracles need extreme rigor. Investing in security audits and adopting a privacy-first mindset, perhaps using zero-knowledge proofs, is non-negotiable.

-

Ethical Considerations: Decentralizing AI doesn’t automatically make it ethical. Issues of bias in training data, the environmental impact of compute-heavy models, and the societal impact of autonomous agents require ongoing, conscious governance from the community.

The 2026 Landscape and Beyond: Key Predictions

Drawing from the top trends and expert analyses, here’s what you can expect as you learn how to combine AI with crypto and Web3:

-

The “Crypto-AI Agent” will become a common user archetype. More people will interact with crypto not through a direct interface, but through an AI agent that manages their wallets, executes strategies, and reports back in natural language.

-

Privacy will become the premier moat. As public blockchains become commoditized, chains that offer built-in, robust privacy (via zk-proofs) will attract the most sensitive and valuable use cases, especially for enterprises and institutions.

-

Stablecoins will become the default payment rail for AI services. An AI agent completing a task will invoice and be paid in USDC or USDT on a scalable chain like Polygon in a matter of seconds for less than a cent. Solving the on/off-ramp problem to connect these digital dollars to traditional bank accounts will be a multi-billion dollar opportunity.

The Future Transformed: Business and Society in an AI x Web3 World

How will AI & Web3 change business? The impact will be profound and pervasive, moving beyond crypto-native sectors into the global economy.

-

Enterprise Automation That Works: Regulated industries will adopt Web3 as “invisible infrastructure” for trusted automation. Supply chains will adjust in real-time using AI predictions, with payments and ownership (via tokenization) automatically settling on-chain. Contracts will become self-optimizing, and fraud detection will be predictive .

-

The Tokenization of Everything (Smarter): Real-World Asset (RWA) tokenization is being supercharged by AI. AI models can provide real-time risk assessment, valuation, and compliance checks for tokenized assets like real estate, carbon credits, or invoices, while smart contracts automate their management and trading .

-

A New Creative and Social Paradigm: Artists will collaborate with AI co-creators, owning the resulting models and outputs as tokenized assets. Social media platforms could evolve into user-owned networks where AI assistants filter information and manage interactions based on user-controlled preferences, not engagement-driven algorithms.

Conclusion

The convergence of AI and Web3 is the defining technological narrative of 2026. It’s not a fleeting trend but the foundation of a new computing paradigm—a “converged internet” that can think, verify, and value autonomously .

Here is your action plan:

-

For Builders: Stop building generic smart contracts. Start architecting intelligent systems. Experiment with agent frameworks like Fetch.ai, integrate verifiable compute from Space and Time, or build a specialized model subnet on Bittensor. Prioritize privacy and verifiability from day one.

-

For Investors: Look beyond tokens as mere speculative assets. Evaluate projects based on their technical architecture for convergence. Favor platforms that solve critical infrastructure gaps (like 0G for data or Ocean for privacy), protocols with clear AI-agent utility, and teams that understand both AI safety and crypto economics.

-

For Everyone: Educate yourself on the principles of decentralized AI. The future belongs to those who understand how to wield intelligence that is open, accountable, and aligned with individual sovereignty, not corporate control.

The question is no longer if you should engage with this convergence, but how and how quickly. The builders and investors who understand how to combine AI with crypto and Web3 today will be the architects of the digital economy tomorrow.

FAQs

What is AI & Web3?

AI & Web3 refers to the powerful convergence of artificial intelligence (machine learning, agents, LLMs) with decentralized web technologies (blockchain, smart contracts, tokens). It creates systems where AI provides dynamic intelligence and automation, while Web3 provides trust, transparency, ownership, and incentive mechanisms .

How can AI help my crypto projects?

AI can help your crypto projects by automating complex strategies (like DeFi yield optimization), enhancing security through real-time threat detection, personalizing user experiences, analyzing vast amounts of on-chain data for insights, and creating intelligent, adaptive products like dynamic NFTs or game worlds .

Does Web3 support AI?

Absolutely. Web3 doesn’t just support AI; it aims to democratize and decentralize it. It provides a trust layer for verifying AI’s actions, a marketplace (via tokens) for monetizing data and models, decentralized compute resources for training, and community-governance models to steer AI development ethically .

How will AI and crypto together revolutionize the future of Web3?

Together, AI and crypto will revolutionize the future of Web3 by transforming it from a set of static, pre-programmed protocols into a living, intelligent ecosystem. They will enable truly autonomous organizations, hyper-efficient tokenized economies, personalized digital experiences, and a new internet where intelligence is a verifiable and tradable commodity, fundamentally changing how we coordinate, create, and exchange value .

What are the top AI crypto coins to research in 2026?

According to analyses, some of the most promising AI crypto coins based on ecosystem strength and clear use cases include Bittensor (TAO) for decentralized AI model training, Fetch.ai (FET) as part of the Artificial Superintelligence Alliance for autonomous agents, and Internet Computer (ICP) for on-chain AI hosting. Others like Render (RNDR) for decentralized GPU compute and The Graph (GRT) for decentralized data indexing are crucial infrastructure plays.

I’m a business owner, not a developer. What’s a concrete example of combining AI and Web3?

A powerful example is tokenizing real-world assets (RWA) and managing them with AI. You could tokenize shares in a commercial property (an RWA). Then, an AI agent could autonomously handle operations: collecting tokenized rent, paying for maintenance (by executing transactions to vendor wallets), and even analyzing market data to suggest optimal times for refinancing or sale. The blockchain provides transparent ownership and automated compliance, while the AI handles complex, ongoing management.

What is “Know Your Agent” (KYA) and why is it important?

KYA is a proposed framework for establishing the identity and credentials of non-human, autonomous AI agents operating on blockchain networks. Just as “Know Your Customer” (KYC) verifies human users for banks, KYA would cryptographically link an agent to its creator/owner, its programmed constraints, and its liability framework. This is essential for trust. Without KYA, merchants and protocols will block AI agents for fear of fraud or unaccountable activity, stifling the entire agent economy.

How does AI help with crypto trading and investment?

AI is revolutionizing crypto investment beyond simple trading bots. Sophisticated AI agents can now perform on-chain analytics to detect early trends, audit smart contracts for vulnerabilities before investing, manage complex, cross-protocol DeFi yield strategies, and provide personalized portfolio insights by analyzing vast amounts of market and social data. Platforms like Web3.ai are pioneering these kinds of decentralized AI toolkits for traders.

Are there reputable companies that can help build an AI-powered Web3 project?

Yes. The market for specialized Web3 development companies is maturing rapidly. Top firms like eSparkBiz, SoluLab, and Cheesecake Labs have dedicated practices for building secure, scalable blockchain solutions and have experience integrating AI elements, whether it’s for NFT marketplaces, DeFi platforms, or custom dApps. When choosing a partner, look for proven expertise in both blockchain and AI, a strong security focus, and clear client testimonials.