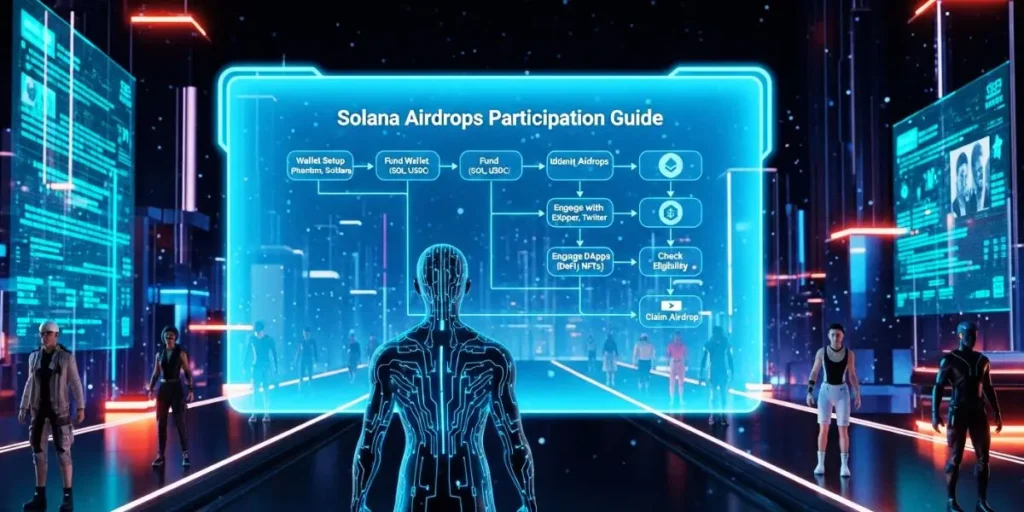

Have you ever felt like you’re always a step behind the next big Solana airdrop, watching others claim life-changing rewards while you figure out the basics? You’re not alone. The world of crypto airdrops is exhilarating but can feel like a closed club where the rules are never clearly explained. This comprehensive guide is your key to that club. We’ll demystify the process, cut through the noise, and provide a clear, actionable roadmap—from setting up your first Solana wallet to successfully claiming your share of the next major token distribution. By following this playbook, you’ll learn not just to participate, but to strategically position yourself for high-value opportunities in the Solana ecosystem.

Forget speculative trading for a moment. The most lucrative, high-conversion funnel in the Solana ecosystem isn’t a new memecoin—it’s airdrops. These strategic token distributions are a project’s ultimate growth hack, designed to reward early believers, decentralize governance, and bootstrap vibrant communities. For you, they represent a non-speculative opportunity to earn free SOL and other valuable tokens simply for being an active, engaged user.

The landscape in 2026, however, has evolved dramatically. The days of easy, low-effort claims are over. Projects like Jito (JTO), Jupiter (JUP), and the recent Solana Seeker (SKR) drop have set a new standard: they reward genuine, sustained participation, not just wallet creation. This guide is your master playbook. We’ll move beyond basic “how to participate in airdrop” advice and dive into the sophisticated strategies that separate five-figure recipients from those left with dust. We’ll cover everything from initial wallet setup to executing a successful claim, ensuring you’re positioned for the next major wave of distributions.

Understanding the Solana Airdrop Ecosystem

An airdrop is a marketing and distribution strategy where a crypto project sends free tokens or coins to wallet addresses. Think of it as a sample or a promotional giveaway, but in the digital asset space. The primary purpose is multifaceted: to raise awareness, reward early supporters, decentralize token ownership, and bootstrap a community and governance system.

The Solana network, known for its high throughput and sub-cent transaction fees, is an ideal environment for airdrops. Its efficiency allows projects to execute large-scale distributions that would be prohibitively expensive on other blockchains, enabling innovative models that go beyond simple giveaways.

Why Projects Launch Airdrops: The Strategic View

From a project’s perspective, an airdrop is an investment in growth. The goals are clear:

-

Community Building & Engagement: Convert casual users into dedicated community members.

-

Rewarding Early Users: Acknowledge and incentivize those who took a risk on the project early.

-

Decentralizing Governance: Distribute voting power to a broad user base, which is crucial for decentralized autonomous organizations (DAOs).

-

Enhancing Liquidity: A wider holder base can lead to better token liquidity on exchanges.

-

Driving Product Usage: Encourage specific, valuable actions within a protocol.

Types of Solana Airdrops You’ll Encounter

Not all airdrops are created equal. Your strategy must adapt to the distribution model. Here’s a breakdown of the most common types you will find in the Solana ecosystem:

-

Holder Airdrops: Tokens are distributed to wallets holding a specific asset (e.g., SOL, a particular NFT, or another token) at a pre-announced snapshot time. Your reward is often proportional to your holding amount.

-

Retroactive/Reward Airdrops: These reward past on-chain activity. If you’ve interactively used a protocol—providing liquidity, trading, or borrowing—you might be rewarded later. This model famously built strong communities for projects like Uniswap and Arbitrum.

-

Bounty or Task-Based Airdrops: You earn tokens by completing specific tasks. These can range from social media actions (likes, retweets) to more technical contributions like writing articles, creating memes, or finding software bugs.

-

Raffle Airdrops: Due to high demand, projects may randomly select winners from a pool of entrants who completed a basic task, like submitting a wallet address. This adds an element of luck to the process.

-

NFT and Gaming Airdrops: Common in the thriving Solana NFT space, these drops reward holders of a specific NFT collection or active players in a blockchain game with new tokens or additional NFTs.

Understanding the Airdrop Matrix: How to Become Eligible for Airdrops

Not all airdrops are created equal. Your strategy must align with the type of distribution. Here’s the 2026 taxonomy:

-

Retroactive Airdrops (The “Thank You”): The most lucrative. Projects snapshot on-chain activity before any announcement, rewarding true early adopters. Examples: Jupiter, Jito. Strategy: Be early and organic.

-

Holder & Staking Airdrops: Reward users for securing the network or holding specific NFTs/tokens. Strategy: Long-term alignment over short-term gain.

-

Incentivized Campaigns / Points Programs: Transparent, ongoing programs where you earn points for specific actions (e.g., trading volume, providing liquidity). These points often convert to future airdrops. Strategy: Consistent, volume-driven engagement.

-

Task-Based & Social Airdrops: Lower-value, higher-effort distributions for community growth tasks. Strategy: Time-permitting; rarely lead to major windfalls.

The Core Principle of 2026: Anti-Sybil & Authenticity

Projects now deploy advanced algorithms to filter out “farmers” and reward real users. They look for:

-

Wallet Longevity: Activity sustained over 3-12 months.

-

Diverse Interactions: Using multiple, reputable Solana ecosystem dApps, not just one.

-

Meaningful Volume: Not a dozen tiny swaps, but genuine, substantial protocol interaction.

-

Unique Behavior: Patterns that mimic a real user, not a bot (varied transaction times, interacting with new releases).

Table: Solana Airdrop Types and Key Characteristics

| Airdrop Type | Typical Trigger | User Action Required | Key Example |

|---|---|---|---|

| Retroactive | Historical usage snapshot | Past organic protocol use | Jupiter (JUP), Jito (JTO) |

| Holder/Staking | Snapshot of asset holdings | Holding or staking tokens/NFTs | Various DeFi and NFT projects |

| Task-Based/Points | Accumulation of points or tasks | Ongoing specific actions & engagement | Backpack Exchange badges |

| NFT/Gaming | Ownership or in-game activity | Holding specific NFTs or playing | Pengu Token for NFT holders |

Your Step-by-Step Blueprint for Airdrop Success

This actionable framework transforms you from a spectator into an active participant. Follow these steps methodically.

Phase 1: Foundation – The Non-Negotiables

Before you interact with a single dApp, your foundation must be rock-solid. This phase is about security and readiness.

1. Set Up and Fund a Secure Solana Wallet

Your wallet is your identity and vault on the blockchain. For airdrop hunting, a non-custodial wallet like Phantom, Solflare, or Backpack is essential. These are software wallets where you control your private keys.

-

Action: Download the wallet browser extension or mobile app. During setup, you will receive a seed phrase (12-24 words). This is the master key to your wallet. Never, under any circumstances, share it, type it online, or store it digitally in plain text. Write it down on paper and keep it physically secure.

-

Funding: You need a small amount of SOL to pay for transaction fees (often called “gas”). Even simple interactions cost a fraction of a cent. Aim to keep at least 0.1-0.5 SOL in your wallet for smooth activity. You can buy SOL from any major centralized exchange (like Coinbase or Binance) and withdraw it to your new wallet address.

2. Embrace Basic Operational Security (OpSec)

The crypto space is a target for scammers, especially around popular airdrops.

-

Rule 1: Never connect your wallet to unverified websites. Always double-check URLs.

-

Rule 2: No legitimate airdrop will ever ask for your seed phrase.

-

Rule 3: Be skeptical of “too good to be true” claims in DMs or unofficial channels.

Phase 2: Strategic Engagement – Playing the Game

With your wallet ready, it’s time to engage. The key is quality over quantity and consistency over bursts.

3. Engage with High-Potential dApps and Protocols

Your on-chain activity is your resume. Projects look for organic, valuable, and sustained interaction. Based on current trends, focus your efforts on these high-probability verticals within the Solana ecosystem:

-

Decentralized Exchanges (DEXs) & Perpetuals: Trade, and especially provide liquidity, on up-and-coming DEXs. Look for platforms with strong technical backing but under $100M in Total Value Locked (TVL).

-

Liquid Staking Protocols: Stake your SOL with newer liquid staking derivatives (LSD) protocols that have a clear need to decentralize their validator set.

-

DePIN (Decentralized Physical Infrastructure): This is a fast-growing sector. Participating may involve running light software nodes or providing data, offering high reward potential for verifiable work.

-

Lending/Borrowing Platforms: Deposit assets or take out loans on emerging DeFi money markets.

4. Cultivate “Real User” Signals

Sophisticated airdrop algorithms are designed to spot farmers. To pass as a genuine user:

-

Interact Regularly: Don’t do 100 swaps in one day and go dormant. Space out your activity over weeks and months. A common filter requires wallets to be active for 60-90 days before a snapshot.

-

Diverse Interactions: Don’t just swap tokens. Mint an NFT, provide liquidity, vote on a governance proposal (if possible), and bridge assets. Diversity shows real exploration.

-

Meaningful Volume: While you don’t need to be a whale, very tiny, trivial transactions may be filtered out. Engage with amounts that are meaningful to you.

-

Use dApp Native Features: If a protocol has a unique feature (like a specific type of limit order or a novel staking mechanism), use it. It’s a strong signal of genuine engagement.

Phase 3: Execution – The Claim and Beyond

When a project announces an airdrop, the work isn’t over. This phase is about securing your rewards.

5. Track Announcements and Check Eligibility

-

Official Sources Only: Follow project announcements on their official Twitter/X account, Discord server, or blog. This is where legitimate claim pages will be linked.

-

Use Trackers: Sites like CoinMarketCap Airdrops, Airdrop.io, or MagicSquare can help you discover new opportunities, but always verify through official channels.

-

Check Your Wallet: For many retroactive airdrops, your wallet (like Phantom) may automatically detect the tokens and notify you. You can also check your wallet address on a block explorer like Solscan or SolanaFM to see all tokens associated with it.

6. Claim Your Tokens Safely

-

Visit the Official Claim Site: Use only the link from the official announcement.

-

Connect Your Wallet: You will typically need to sign a transaction to claim, which incurs a small SOL fee.

-

Beware of Scams: At this moment, scam sites proliferate. Double, then triple-check the URL. If a site feels off, leave and re-check the official Discord.

7. Post-Claim Strategy

Congratulations! You have tokens. Now what?

-

Research the Token: What is its utility? Is it a governance token? Does it provide fee sharing?

-

Secure It: Consider moving a portion to a more secure long-term storage solution, like a hardware wallet.

-

Evaluate Options: You can hold, stake it within the ecosystem for more rewards, or trade it. Your decision should align with your belief in the project’s long-term viability.

Claim Sites vs. Direct Drops: A Critical Distinction

A major evolution in airdrop mechanics is the claim site. Unlike a direct drop where tokens appear in your wallet, a claim site requires you to actively visit a webpage, connect your wallet, and press a “Claim” button to receive your allocation.

| Feature | Direct Airdrop | Claim Site Airdrop |

|---|---|---|

| User Action | Passive (tokens arrive automatically) | Active (must visit site and claim) |

| Cost Bearer | Project pays all distribution gas fees | User pays the gas fee for their own claim |

| Project Cost | High (fee per wallet) | Very low (one-time site setup) |

| Best For | Small, targeted drops; high-urgency | Large-scale, cost-effective distributions |

| Security Risk | Low (if from a legitimate source) | Higher (risk of phishing sites) |

For projects, a claim site is far more economical for distributing to a large audience. As noted in one analysis, the cost of a direct airdrop is approximately 0.00304 SOL per wallet, while creating a claim site costs a flat 0.1 SOL. For any distribution to more than 33 wallets, the claim site is cheaper. For you, the participant, this means vigilance is paramount. Always verify claim links through official project channels like Twitter, Discord, or Telegram.

Advanced Tactics: From Participant to Strategist

Once you’ve mastered the basics, these advanced concepts can significantly increase your efficiency and success rate.

Understanding the 2026 Eligibility Algorithm

Think like the project team. They want to distribute tokens to users who will remain active, not just sell immediately. Modern criteria often include:

-

Wallet Age & History: A long-standing wallet with a history of varied activity is gold.

-

Depth of Interaction: Using multiple features of a protocol is better than repeating one simple action.

-

Anti-Sybil Clustering: Algorithms can link wallets funded from the same source or performing identical actions at the same times. Focus on one or two high-quality wallets, not a farm of ten.

The Solana Mobile Strategy

The launch of devices like the Solana Saga (and its successors) has opened a new frontier. Projects like Solana Mobile explicitly reward on-chain activity conducted natively through their device’s wallet and dApp store.

-

If you have a Solana mobile device: Use it as your primary mobile Web3 tool. Conduct swaps, mint NFTs, and interact with dApps directly from the device. Data suggests that consistent, organic transactions (5-10 per day) from the native wallet are tracked and can significantly boost eligibility for dedicated airdrops.

Essential Tools for the Airdrop Hunter

Arm yourself with the right software to navigate the ecosystem confidently.

| Tool Category | Recommended Options | Primary Use |

|---|---|---|

| Wallet | Phantom, Solflare, Backpack | Securely store assets, interact with dApps, claim tokens. |

| Block Explorer | Solscan, SolanaFM | Investigate transactions, verify token holdings, and check wallet histories. |

| Airdrop Tracking | CoinMarketCap Airdrops, Airdrop.io | Discover announced and upcoming airdrop campaigns. |

| Community & Info | Project Discord & Twitter, Solana Floor | Get real-time news, verify official links, and join communities. |

Your Battle Station: Setting Up the Ultimate Solana Airdrop Hunting Wallet

Your wallet is your identity. Setting it up correctly is the foundational step to claim your Solana wallet’s future rewards.

1. Choose Your Primary Wallet:

Select a mainstream, reputable wallet like Phantom, Solflare, or Backpack. These are automatically monitored by many projects for eligibility. This will be your “main” identity for high-value interactions.

2. The Devnet Sandbox:

Before risking real funds, use the Devnet Solana environment. Many projects, especially in DePIN or gaming, launch testnets first. Participating in a Devnet Solana airdrop or testnet activity is a strong positive signal for mainnet rewards. It shows you’re a tester, not just a mercenary.

3. Fund Strategically:

You don’t need thousands. Start with 0.5-1 SOL. You need enough for:

-

Transaction fees (minimal on Solana).

-

Small trades and providing liquidity on DeFi protocols.

-

Minting or purchasing key ecosystem NFTs.

Keep a small buffer of SOL to pay for claim transaction fees when the time comes.

4. Secure It Absolutely:

-

Use a hardware wallet for your primary vault.

-

Never share your seed phrase.

-

Bookmark official sites to avoid phishing links.

Active Protocol Participation: The Key to High-Value Claims

Eligibility is earned, not given. Here is your actionable engagement checklist for the next 90 days.

DeFi & Trading Layer:

-

Swap & Trade: Regularly use top DEXs and aggregators like Jupiter for token swaps. Aim for consistent, reasonable volume over time.

-

Provide Liquidity: Deposit token pairs into liquidity pools on platforms like Orca. Long-term deposits (30+ days) are weighted more heavily.

-

Lend & Borrow: Use lending protocols like Solend or Kamino to lend your assets or take out small, repaid loans.

-

Stake SOL: Stake a portion of your SOL with a reputable liquid staking protocol like Jito or Marinade. This is a strong proof-of-commitment signal.

NFT & Gaming Layer:

-

Engage with Major Marketplaces: Trade NFTs on Magic Eden and Tensor. Holding certain “blue-chip” ecosystem NFTs can grant multiplier bonuses in future airdrops.

-

Participate in NFT Drops: Mint from reputable Solana-native projects.

-

Play Games: Engage with blockchain games on Solana. Some, like projects associated with Paws Solana, may reward early players.

Emerging Sectors (High Potential):

-

DePIN: Explore physical network projects like Helium (HNT) or Hivemapper. Running a node or contributing data is a powerful, Sybil-resistant claim to rewards.

-

Consumer Apps & DAOs: Join and participate in the governance of emerging DAOs.

The Tier 1 Hunt: Deep Dive into Major Protocols

Let’s analyze specific, high-potential verticals. This is where you should focus your quality attention.

-

Perpetual DEXs & Advanced Trading (e.g., Drift Protocol): These platforms need sophisticated users and deep liquidity. Your goal here is to be a consistent trader, not a one-hit wonder. Provide liquidity on their platforms if possible.

-

Liquid Staking & Yield (e.g., Kamino Finance): Protocols like Kamino that offer automated strategies value long-term depositors. Using their vaults or borrowing services over several months is key. The Kamino airdrop model rewarded sustained users.

-

NFT Infrastructure (e.g., Tensor, Magic Eden): The Tensor airdrop famously rewarded active NFT traders on its platform. Similarly, Magic Eden has conducted its own Magic Eden airdrop. The strategy is clear: be an active buyer and seller on these platforms, not just a holder.

-

Mobile & Hardware (Solana Seeker): The recent Solana Seeker airdrop for SKR tokens was exclusive to Seeker phone users and developers. This highlights a trend: deep integration with niche ecosystem hardware/software can yield exclusive rewards.

The Claiming Process: How to Claim Your Solana Airdrop

When the moment arrives, precision is key. Here is the universal claiming workflow.

-

Discovery & Verification: You’ll typically learn of a claim via official project Twitter, Discord, or a notification in your wallet (e.g., Phantom). NEVER click random links. Go directly to the project’s official website or use the link in your wallet.

-

Eligibility Check: Connect your wallet to the official claim portal. It will show your allocated amount. For example, to check airdrop Solana allocations for projects like Jupiter, you visited their official dashboard.

-

The Claim Transaction: Click claim. Your wallet will prompt you to sign a transaction and pay a small gas fee (in SOL). Ensure you have that SOL in your wallet.

-

Post-Clain Verification: After signing, check your wallet balance or a block explorer like Solscan to confirm the tokens arrived.

Pro Tip: Network congestion is common during popular airdrops. Be patient, and don’t spam transactions. Your claim will go through.

Post-Claim Strategy: Maximizing Your Airdrop ROI

You’ve claimed. Now what? This is where you convert an airdrop into lasting value.

-

Immediate Actions: Always claim your airdrops as soon as safely possible. Unclaimed tokens often return to the treasury after a deadline (e.g., the SKR airdrop has a 90-day window).

-

Evaluate the Project: Is this a token with long-term utility and a strong team, or a likely “pump and dump”? Read the docs.

-

Strategic Decisions – A Simple Framework:

| Your Belief in the Project | Recommended Action | Reasoning |

|---|---|---|

| Strong | Stake/Hold. Stake the tokens within the project’s ecosystem if possible (like staking SKR to earn rewards). | Aligns you for potential future rewards, governance power, and demonstrates long-term commitment. |

| Neutral/Uncertain | Sell 50%, Hold 50%. Take initial capital off the table while maintaining skin in the game. | Balances profit-taking with ongoing upside exposure. A classic risk-management move. |

| Weak | Sell 100%. Convert to SOL or a stablecoin. | Frees up capital to recycle into new airdrop hunting activities or safer assets. |

Safety First: Navigating Scams and Protecting Your Assets

The airdrop space is a scammer’s playground. Your vigilance is your ROI.

-

The Golden Rule: Never, ever share your seed phrase or private key. No legitimate project will ask for it.

-

Website Safety: Always double-check URLs. Use bookmarks. Fake “claim” sites are the #1 threat.

-

Token Verification: When you receive an airdrop, verify the token mint address on Solscan against the official project announcement. Fake tokens are common.

-

Too-Good-To-Be-True: Ignore DMs, emails, or tweets promising guaranteed airdrops or asking you to “validate” your wallet. It’s always a scam.

-

Official Channels Only: Rely on information from the project’s official Twitter or Discord, and cross-reference with major community news sources.

The excitement of a potential airdrop can cloud judgment. Use this checklist before every claim attempt:

-

Source Verified: Is the link from the project’s verified Twitter/Discord?

-

URL Inspection: Does the website URL match the project’s official domain exactly?

-

No Seed Phrase Request: The site will never, ever ask for your 12-24 word recovery phrase.

-

Sensible Permissions: When connecting your wallet, review the transaction. Does it only ask for a signature to claim, or is it requesting unlimited spending approval on all your tokens?

-

Too Good to Be True: Is the promised allocation suspiciously large for your level of activity? If it seems too good to be true, it is.

The biggest threat during an airdrop is phishing. Scammers create perfect replicas of claim sites.

-

Never, Ever Share Your Seed Phrase: A legitimate site will never ask for your 12 or 24-word recovery phrase.

-

Beware of “Unlimited Approvals”: When your wallet asks for permission, check if the approval amount is for the exact airdrop sum or an “unlimited” amount. Never grant unlimited token approvals to unknown sites. Use tools like Revoke.cash to review and revoke old permissions.

-

Verify Smart Contract Audits: Reputable projects audit their claim site contracts. Look for audit badges from firms like Coinfabrik or Halborn. Platforms like Smithii, which offer no-code claim site creation, promote their audits to build user trust.

-

Trust Your Instincts: If a site feels off, looks poorly designed, or promises unrealistic returns, close it immediately.

Beyond the Claim: Post-Airdrop Strategy

Claiming the token is not the end of the journey. What you do next can impact your long-term returns.

-

To Sell or to Hold? Consider the project’s fundamentals. Did you receive a governance token? Holding and participating could lead to future rewards. Was it a meme coin with no utility? Your strategy may differ. Always account for potential tax implications.

-

Re-stake or Provide Liquidity: Some projects offer extra yield for staking your airdropped tokens or providing them as liquidity in a pool. This can amplify rewards but comes with impermanent loss risk.

-

Stay Engaged: Continued participation in the project’s community and governance can make you eligible for future retroactive airdrops or reward phases.

Project Perspective: Launching Your Own Airdrop

If you’re building on Solana, understanding airdrops from the distributor’s side is crucial.

-

Choosing Your Model: Will you use a direct transfer, a claim site, or a vested airdrop? Vested airdrops, where tokens unlock over time, are excellent for aligning long-term incentives and preventing immediate sell pressure.

-

Legal and Regulatory Compliance: Airdrops are not free from regulation. In some jurisdictions (like the U.S.), they can be viewed as securities distributions. It is critical to seek legal counsel to structure your token distribution properly, define token vesting schedules for teams, and understand the implications of “good” and “bad” leaver clauses in incentive schemes.

-

Using No-Code Tools: Platforms like Smithii allow projects to create secure, audited claim sites without programming, offering a cost-effective and trustworthy distribution method. Their public audit by Coinfabrik is a key trust signal for both project and participant

Conclusion: Your Journey to Becoming an Airdrop Insider

Participating in Solana ecosystem airdrops is a skill that blends preparation, strategy, and security. It starts with the absolute basics—a secure, funded wallet—and evolves into strategically shaping your on-chain behavior to align with what projects value most: genuine, sustained engagement. Remember, the largest rewards historically have gone not to those who gamed the system, but to those who were authentically curious and active participants in the ecosystem’s growth.

The landscape will continue to change, but the core principles in this guide will remain your compass. Start by solidifying your foundation today, choose one or two promising Solana dApps to engage with consistently, and begin building your on-chain reputation. The next major Solana airdrop could be just around the corner.

Ready to take the first step? Share which Solana ecosystem project you’re most excited to start using in the comments below, and let’s discuss strategies!

Frequently Asked Questions (FAQs)

How much does it cost to start hunting for Solana airdrops?

You primarily need SOL to pay for transaction fees (“gas”). These fees are extremely low on Solana, often a fraction of a cent per transaction. To start comfortably, funding your wallet with 0.1 to 0.5 SOL (approx. $10-$50, depending on price) is more than sufficient for hundreds of interactions. The investment is in your time and strategic effort, not large capital.

Can I use the same wallet for all my airdrop activities, or should I use multiple?

Quality beats quantity. Modern anti-Sybil detection is sophisticated and can link wallets with similar funding and behavior patterns. It is generally more effective to build a strong, long-term history with one primary wallet than to dilute your effort across many. Use a single, secure wallet for your genuine ecosystem engagement.

What’s the difference between Devnet/Solana faucet SOL and real SOL?

Devnet, Testnet, and faucet SOL are not real money. They are test tokens that developers and users can obtain for free to experiment with applications without financial risk. Real SOL exists on the Mainnet Beta cluster and has monetary value. Activity on Devnet/Testnet does not qualify for real airdrops. Ensure your wallet is set to “Mainnet” (not Devnet) when conducting airdrop-related activities.

How long do I need to be active before expecting to qualify for an airdrop?

There’s no guaranteed timeline, as it depends on the project. However, data from recent major airdrops suggests that projects often analyze 3 to 12 months of on-chain activity prior to a snapshot. A common minimum threshold is a wallet that has been active for at least 60-90 days. The key is to start now and be consistent; you are building a verifiable history of engagement.

What should I do immediately after receiving an airdrop?

First, verify the token. Check its contract address on a block explorer like Solscan against the official project announcement to ensure it’s not a scam “imposter” token. Then, research its utility. Finally, decide on a strategy: you can hold it, stake it within the project’s ecosystem to earn more, or trade it. Always prioritize moving a portion to secure storage if the value is significant.

How to claim Solana airdrop?

You claim a Solana airdrop by connecting your eligible wallet to the project’s official claim website, signing a transaction, and paying a small network fee in SOL. Always verify the website’s authenticity first.

How to claim Solana Seeker airdrops?

The Solana Seeker (SKR) airdrop is claimed directly on the device. Open the Seed Vault Wallet on your Seeker phone, navigate to the Activity Tracking tab, and tap “Claim SKR.” You need about 0.015 SOL for the fee.

How do you claim your airdrops?

You claim your airdrops by first verifying your eligibility on the project’s official portal, then authorizing the claim transaction in your wallet. Ensure you have enough SOL for gas fees and that you are on the correct, official website to avoid scams.

How do I claim my Solana wallet?

You don’t claim the wallet itself. You claim tokens that have been airdropped to your Solana wallet address. This is done via the specific project’s claim process, not through your wallet’s basic functions.

How to participate in airdrop?

To participate in an airdrop, you must meet the project’s eligibility criteria, which usually involves actively using their protocol or the broader Solana ecosystem before a snapshot is taken. Merely holding a wallet is rarely enough.

How to become eligible for airdrops?

Become eligible for airdrops by being a genuine, active user of the Solana ecosystem. This includes trading on DEXs, providing liquidity, staking SOL, interacting with NFT marketplaces, and participating in new protocol testnets over a sustained period.

How to farm Solana airdrop?

“Farming” in the modern sense means strategically engaging with pre-token protocols to meet future eligibility criteria. Focus on high-potential projects, interact meaningfully and consistently, and avoid Sybil behavior (creating many wallets) as modern filters will detect and disqualify you.

What’s the minimum SOL I need in my wallet to participate in airdrops?

You don’t need a specific minimum to be eligible, but you should have a small amount (0.1-0.5 SOL) to pay for transaction (gas) fees when interacting with dApps and claiming tokens from claim sites.

I connected my wallet to a site to check eligibility, but it says I’m not eligible. Why?

Eligibility is based on strict, on-chain snapshot data. Common reasons include: your wallet didn’t perform the required actions before the snapshot date, you’re checking the wrong wallet, or the project has a points system where your activity wasn’t sufficient. Always check the official eligibility criteria.

Are Solana airdrops taxable?

In most jurisdictions, including the U.S., receiving airdropped tokens is considered taxable income at their fair market value on the day you receive them. When you later sell them, you incur capital gains or losses. Always consult with a tax professional familiar with cryptocurrency.

What’s the difference between an airdrop and a claim site?

An airdrop is the general event of distributing free tokens. A claim site is a specific mechanism for that distribution where users must actively visit a website to claim their tokens, paying their own gas fees. This is more cost-effective for projects distributing to large audiences.

How can I tell if an airdrop claim website is a scam?

Major red flags: the URL is slightly misspelled, the site design is poor, it asks for your seed phrase, the wallet connection prompts an “unlimited approval,” the link came from a direct message (DM), or there is no mention of a smart contract audit from a firm like Coinfabrik or Halborn.

What tools can I use to track my potential airdrop eligibility across projects?

Portfolio dashboards like Step Finance are excellent for seeing your on-chain activity holistically. Manually tracking your interactions with new protocols and noting any “points” programs they announce on Discord or Twitter is also essential.

Is it worth using a separate wallet just for airdrop hunting?

Yes, this is a highly recommended security practice. Using a dedicated “hot wallet” with a limited amount of SOL for interacting with new dApps and claim sites isolates your risk. Your main assets should be stored in a more secure wallet, ideally connected to a hardware wallet like a Ledger