Also known as Pin Bar, Hammers, Spinning tops, or long-tailed candles. They are one of the tradable candlesticks that we find very often on the charts. There are many pages written about it and you may have an idea of what it is. you have an idea of what it is all about.

Finally, here you will discover the keys to how to trade long-tailed candlesticks; when to enter, when to exit, where to set your TP (Take Profit), where to set SL (Stop Loss), and, above all, when not to trade the hammers.

You will learn to distinguish which long-wick candlesticks are tradable and which are best left untraded. Not all long-wick candlesticks are tradable. I will guide you in minimizing risk, learning to trade the most profitable ones, with a higher OR (Opportunity: Risk) ratio, and discarding those with low winning possibilities.

What is a long wick candlestick?

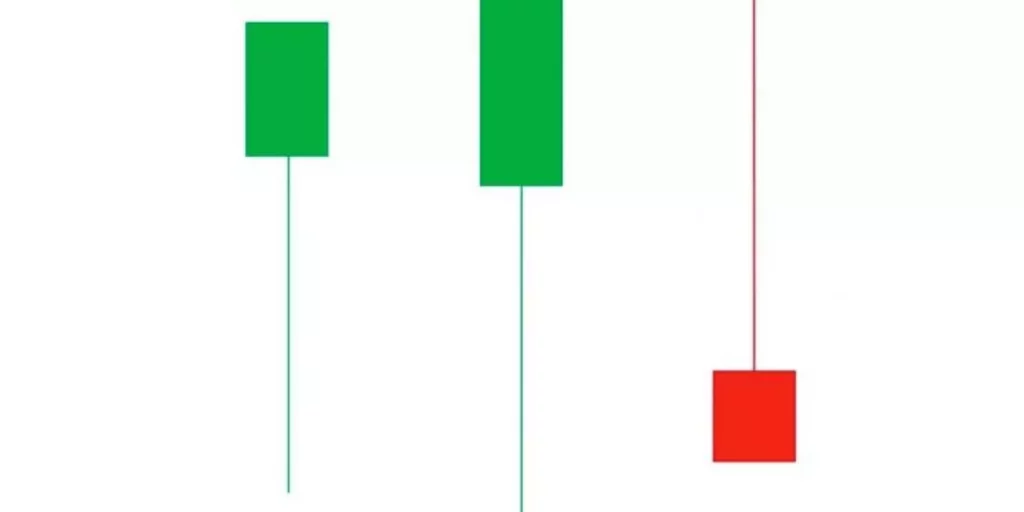

We define a long-wick candlestick as a simple candlestick formation with a long wick and, not least, a small body or head.

The greater the disproportion between the wick and the body, the better. Indistinctly the long wick and the body can be found at the top or the bottom of the candle.

Of course, they will have a different will of different meanings and we will consider this when trading. We see it a few paragraphs later.

Here you can see the two types described above. Both are equally common and equally tradable. To avoid confusion, we will call one of them a bearish long-wick candlestick (the red one) and the other a bullish long-wick candlestick (the green one). Also known as the inverted hammer (bearish) or hammer (bullish), and reversal pin bars, either bullish or bearish.

Let’s not focus so much on the names and continue learning how to trade candlesticks.

learning how to trade long-wick candlesticks, that’s what we are here for.

Meaning of long wick candlesticks

Within the description, it is worth noting not only the format but also the meaning of long wick candlesticks in the trading context.

These candles represent a saturation in the price and, usually, an imminent regression in the price of the asset we are trading.

Let’s take the bearish candlestick in the image (the red one) as an example; the long wick at the top means nothing more than that the price reached a high point and then sellers came into play to make the price practically returned to the starting point.

Conversely, with the green candlestick (bullish), the price reached a low point and from there the buyers took control of the asset to bring the price back to starting point levels.

In both cases, we are faced with price saturation. Either the highest or the lowest price where traders have seen the opportunity to buy or sell, as the case may be. to buy or sell, depending on the bullish or bearish case.

Ideal long wick candlestick location

Before we get excited and go out looking for long wick candles to trade, please keep in mind that; 1) The ideal location of a bullish pin bar is at support and 2) The ideal location of a bearish long wick candlestick is in the support zone.

In the middle of a rise or fall one or several long wick candles may appear and, most of the time they do not mean much or rather mean nothing.

Ideal timing for trading long wick candlesticks

For those of you who already know our Professional Price Action leathers, you know that we do not trade charts for less than 4H, and, by default, our guiding chart is the daily chart (D1).

Following the same premise, to trade pin bars, I do not recommend trading on timeframes other than 4H, D1, W1, or M1, i.e. 4 hours, 1 day, 1 week, or 1 month, where the results will be more likely to appear. Does this mean that we cannot trade hammer candlesticks in smaller time frames such as 1 hour (1H) or 15 trades, with small lots (0.01), or in a demo account?

However, you will notice that you will need much more work for much smaller results:

1. Because supports and resistances are less defined at lower time frames.

2. A long wick candlestick can form at low time frames due to momentum noise. For example due to the release of economic data, NFP, unemployment rate, etc.

3. Because we price action traders don’t check charts shorter than 4 hours. Ok, I admit, sometimes we look at them, that’s what they are there for… but it’s a NO.

but it is a definite NO when it comes to trading.

4. Price action, by its nature, encourages Swing Trading with higher returns on longer-term trading, rather than many trades during the day (intraday or intraday), to profit from a handful of pips after a lot of work.

Trading a long-wick candle

Let’s analyze how to trade a bearish long-wick candlestick. This is with the long wick at the top, with a small red body, the smaller the better. In the image below I show the two, both bullish and bearish. bullish and bearish.

Of course, the bullish candlestick works the same as the bearish one but the entry and exit points will be set on the opposite side.

Keeping in mind the meaning described above. A long wick candlestick means that the price reached a high point from which, traders (you and me) decided not to continue buying, but on the contrary, to sell.

The chances that selling will continue beyond the base of the candle are potentially high, while the chances of buying and returning to dominate, although they exist, are lower.

Now, can we activate our sale right at the close of the candle at the bottom? Yes, of course, but it is not advisable to rush.

Forex trading, among other things, consists of knowing how to keep calm and locate the entries that will give us the highest profitability with the minimum risk.

If we enter (sell) right at the bottom of the candle, we risk buyers taking control of the market again and thus increasing our losses if they occur. We will avoid this situation as much as possible.

The (ideal) entry in long-wick candlesticks

For this, it is advisable to wait patiently to activate our sale at about the middle of the long-wick candlestick.

In this way, if the candle does not work, our loss is halved and our profit will be increased accordingly.

Setting SL (Stop Loss) on long wick candlesticks

For all the above described, when trading bearish long wick candles, we should set our Stop Loss (SL) just above the long wick. Some people set it just at the highest point.

It is recommended to set it a few pips higher because the spread effect can play a trick on us and close the trade with a loss.

If you can afford it, set the SL 10, 20, or even 30 pips above the highest point of the candlestick to avoid the execution of our SL accidentally.

If you can’t afford to set your SL above the high point, it probably means that either; 1) you can’t afford the trade or 2) you entered too early at the bottom of the candle. Whatever the reason, please think, analyze, and calculate before any entry, even if it is extreme, always put yourself in the worst-case scenario.

TP (Take Profit) setting on long wick candlesticks

As a general rule, take profit trading a pin bar or inverted hammer will be at a distance below the same distance candle as the candle itself.

This is the easy and profit-taking theory more or less quickly. However, my recommendation is that you keep in mind the context of the trade.

Keep in mind that the bearish candlestick will, not infrequently, present itself at chart resistance. If it is a trend reversal candlestick at the high point (resistance), we can assess the option of the impending downside reaching the next support level.

This is not a far-fetched idea and, therefore, we have before us the possibility of a swing trade entry with good profit prospects.

Conclusion: Operate long-wick candles!

Long wick candles appear on our charts. Don’t talk about 5M, 15M, 30M… no! our charts are D1 and, at the very low end we accept 4H. You can look at the history of your favorite pairs, the past 2 or 3 weeks, 1, 2, or 3 months.

You will see for yourself the opportunities that presented themselves and will potentially present themselves again in the future, you just have to be attentive.

Even if you don’t spot more than 1 or 2 a month, the odds of profit make it worthwhile to be on the lookout and try trading them.

Who wouldn’t like to master a strategy that would allow them to work a couple of times a month with positive results? Don’t wait any longer and start trading long-wick candlesticks.

Supercharge your Bitcoin trading with Margex – the leading platform for leveraged trading. Unlock your full potential and ride the wave of cryptocurrency success. Join Margex now and experience advanced tools, tight spreads, and lightning-fast execution for your Bitcoin trades.

Disclaimer: Some of the links on this page could be affiliate links, where I earn a commission if you make a purchase via my link. This helps me continue to create the free content that I put out.

Follow us on our social networks and keep up with everything that happens in the Metaverse!

Twitter Linkedin Facebook Telegram Instagram Google News