While the crypto market was in decline and the news feed reported one drop after another, my portfolio grew by 160% in 3 months! And it’s not because I’m the best trader on the market or have found a secret Telegram channel that reveals money-making methods. It’s the AI signals sent to me by an AI agent that analyzes the market around the clock. Setting up AI is not that difficult. It can be used as a personal assistant for trading and market analysis.

For example, in September 2025, an AI agent found a token with abnormal on-chain volume and whale accumulation. This was long before the token pump. That token was MYX Finance (MYX). I bought it for $2,000 as an experiment based on the AI trading signals and earned $18,000 on the pump. A week after the purchase, the token rose from $1.3 to $14.

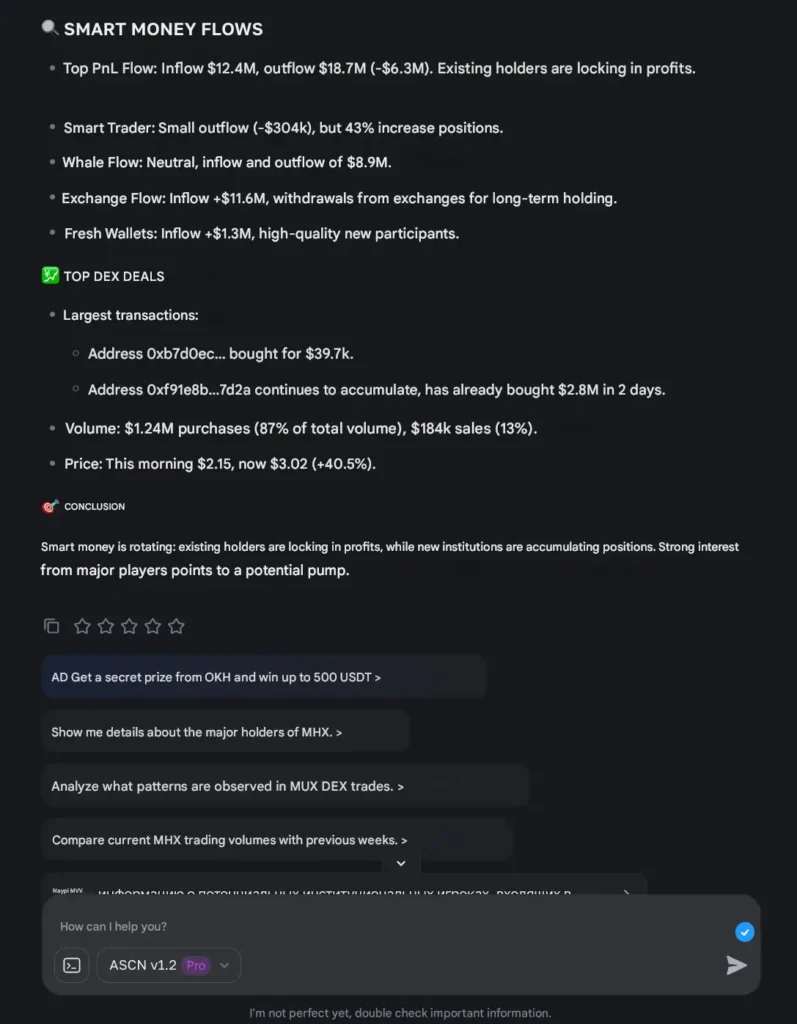

I used the AI prompt “Find tokens with abnormal volumes on the BSC network, filter them by liquidity and concentration in top wallets.” Then, after receiving the list of tokens, I added a clarifying prompt: “Show the top buyers of each token and analyze smart money and whales over the last 2 days.”

As a result, the AI assistant showed me which tokens had seen growth in volume and accumulation from smart wallets, as well as the absence of mass deposits on CEX. Thus, I found a token that whales had already noticed, but which mass investors had not yet seen, as there had been no positive news about the project. However, a regular ChatGPT or Grok would have given something generic like “there was no positive news about the project” or “I don’t have any data to analyze.” Therefore, the main trick is to find an AI that has access to blockchain data. And I found it — it’s ASCN.AI.

In this article, I will tell you exactly how I use AI agent to make money in crypto, which AI models I have tried, and show you my case studies and working prompts you can use right now. Let’s go!

How AI assistants changed crypto trading in 2025

Since AI agents entered the crypto market and the market itself accelerated to the limit, the use of AI assistants among traders has become commonplace. It is physically impossible to analyze hundreds of new tokens and dozens of narratives. The enormous amount of information noise on social media drowns out the truly important signals, which are difficult to find manually.

With the growing number of exchanges, funds, and audiences in crypto, collecting data manually has become extremely difficult. There are too many CEX and DEX exchanges, smart contracts, capital movements between networks, and projects themselves.

That is why AI has become an essential tool. Many funds and professional traders already use it. It can handle 90% of routine analysis tasks and become your competitive advantage.

That is why I started looking at various LLMs in search of a working tool.

What AI crypto traders use: from ChatGPT and Grok to ASCN.ai

For those who are not yet familiar with LLM models, they are language models where you write text and receive a response. The most popular LLM models are ChatGPT, Gemini, Grok, ASCN.AI, DeepSeek, and others. They all work similarly. The only differences are the sources of information and the additional functionality that AI can provide.

The problem with many LLMs is that they are strong at writing text but weak at reading and analyzing blockchain and on-chain metrics. For example, ChatGPT and Grok are good at writing text and answering general questions. Still, they are weak at Web3 tasks because they are not connected to blockchain nodes or market data, which means they cannot read transactions or determine the behavior of smart money and funds.

The only tool I have found that is connected to blockchain data is ASCN.AI. It is a specialized AI crypto agent trained on Web3 data and, in addition to text analysis, can analyze data, charts, metrics, and transactions. It allows you to:

- Find undervalued altcoins. Ascn can analyze crypto projects in seconds, rather than the dozens of hours a crypto analyst would spend. AI will study the whitepaper, tokenomics, project news, holder activity, and smart money. Conduct technical analysis of the chart; determine the likely risks and profits; and suggest the most successful time to buy the token and its subsequent sale.

- Among other things, AI can assess the likelihood of a scam or rug pull. The bot will analyze the behavior of the project’s founders, examine transaction patterns on their wallets, and provide a summary of potential risks.

- Also, thanks to API access, you can create your own AI assistant, train it with your analysis technology, and even share it with other users.

After the recent Ascn 1.2 update, the model has pulled significantly ahead, surpassing most popular LLMs in accuracy and report quality.

However, models without access to nodes are also widely used by traders. For example, after Gemini was updated to version 3, the model significantly improved its analysis capabilities, so many traders began using it for sentiment analysis. In fact, after the update, it became more powerful than ChatGPT, but many traders continue to use only ChatGPT out of habit. If you are one of them, you should broaden your horizons and periodically test new tools, as new LLMs often take the lead.

ChatGPT vs Gemini vs ASCN.ai: Which is the best AI agent for crypto trading?

To compare different AI agents in practice, I decided to enter the same queries into each and assess the quality and depth of the responses. For the experiment, I chose ChatGPT, Gemini, and ASCN.

For example, I have a TWT token in my portfolio. I haven’t followed it for a long time and want to do some quick research on the latest news, conduct a technical analysis, and make a forecast. I wrote the prompt “Provide a comprehensive analysis of the TWT token (Trust Wallet). What is the best price to buy it and to sell it? Analyze regularities, whale behavior, and sentiment” and sent it to 3 LLMs.

ChatGPT gave the worst result — too much unnecessary information and weak analysis.

Gemini provided a good analysis with relevant information, but lacked depth.

ASCN gave the fastest response, with all the necessary information and good depth. Nothing superfluous.

For the second example, I asked the question “Provide me with deep on-chain and market analytics for DezXAZ8z7PnrnRJjz3wXBoRgixCa6xjnB7YaB1pPB263 (BONK): live metrics, top spot/perp volumes and smart flows, token movements across all key wallets, top holder balances, open perp positions, inflows/outflows.”

The situation repeated itself. ChatGPT gave a rather banal answer with no deep analysis.

Gemini was better at analysis than ChatGPT, but still inferior to ASCN in terms of depth and speed.

ASCN gave the most detailed and fastest response.

Thus, ASCN can provide the best answers to Web3-related questions.

How I use ASCN in crypto trading: my use cases

Let’s continue with the case studies. During my latest market research, I noticed bullish sentiment towards the PUMP token in many chat rooms. I began to analyze the token using various AI tools. ChatGPT and Gemini responded that the token was growing, the news background was good, and predicted it would go to the moon. They referred to news about the project.

ASCN, on the other hand, showed the opposite. On-chain data showed that large wallets belonging to whales and funds began to exit their positions and dump tokens at retail prices during the peak of positive news. It also noted that flows on CEX exchanges from private investors had increased, and that sentiment on social media had become overheated.

Thus, ASCN concluded that the pump was already ending and that it was time to take profits rather than open new long positions. I did not invest in the token, and after a couple of days, it began to fall due to high sales volume. I did not make money on this case, but ASCN helped me anticipate the price drop and avoid losses by resisting crowd influence.

Let me tell you about another case. I was looking for a successful trader to start copy trading. I asked ChatGPT, “Display new Successful Trader wallets (created ≤30 days ago), their top purchases, and average hold period.”

However, ChatGPT directly replied that it does not have access to on-chain data and cannot compile such a list of wallets.

ASCN provided a list of wallets in response to the same question—precisely what I needed. ASCN was able to do this because it has direct access to blockchain nodes.

So, I obtained a list of successful traders’ wallets, selected a few of them, and started replicating their trades. Few copy traders use this method, so you can achieve better results compared to public traders, whose trades are copied by hundreds of copy traders, squeezing their earning potential to zero.

Why ASCN.AI became my primary crypto AI assistant

Among all LLM models, ASCN is the best AI assistant for crypto, and it is currently the only model with access to blockchain nodes. This significantly improves the quality of analysis and the depth of responses. AI can find profitable trades and provide concrete figures rather than vague news headlines. Since it was trained on Web3 data, it offers stronger answers than universal LLMs and helps you earn even in a falling market.

By registering, you can test ASCN and make 5 free requests. You can ask, for example, “Track where funds reinvested profits after exiting (TOKEN): transfer sequences → new positions” or, for example, “Give 3 scenarios for the development of the cryptocurrency market in the next 12 months and how to optimize the investment portfolio for each of them.”

ASCN can become your indispensable assistant in analysis and trading. Well, if you are trading in 2025 and still not using AI, you are simply giving money to those who do. I hope you found my article helpful. Good luck!

Conclusion

This article demonstrates a powerful shift in cryptocurrency trading: AI is no longer a speculative tool, but a critical advantage for modern investors. By moving beyond generic chatbots like ChatGPT to specialized AI agents with direct blockchain data access—such as ASCN.AI—traders can uncover hidden opportunities and avoid common pitfalls. The key takeaway is that success now depends on leveraging AI to interpret on-chain data, whale activity, and market sentiment in real-time, turning overwhelming information noise into actionable, profitable signals. As the market evolves, integrating a capable AI assistant isn’t just an option; it’s becoming essential for staying competitive and consistently profitable.

FAQs

1. Do I need to be a trading expert to use AI for crypto?

No. The AI agent handles complex data analysis, allowing you to focus on executing informed decisions based on its clear signals and insights.

2. Why are general AI models like ChatGPT not ideal for crypto trading?

Models like ChatGPT or Grok are not connected to real-time blockchain data, nodes, or on-chain metrics. They excel at text but cannot analyze transactions, smart money movements, or live market conditions essential for crypto.

3. What makes ASCN.AI different from other AI tools?

ASCN.AI is specifically trained on Web3 data and has direct access to blockchain nodes. This allows it to perform deep on-chain analysis, track whale wallets, evaluate tokenomics, and assess risks—functionality general-purpose LLMs lack.

4. Can AI guarantee profits in cryptocurrency trading?

No. AI significantly improves analysis and identifies high-probability opportunities, but it does not eliminate risk. Market conditions remain volatile, and due diligence is still required.

5. How did the author achieve a 160% portfolio growth?

By using ASCN.AI to detect early signals—like abnormal on-chain volume and smart money accumulation in tokens such as MYX Finance—before major price pumps and by avoiding overhyped assets based on AI-driven risk analysis.

6. Is ASCN.AI free to try?

Yes, new users can make 5 free requests after registration to test its capabilities with prompts like tracking fund movements or analyzing specific tokens.

7. Can I use AI for copy trading?

Yes. The author used ASCN.AI to identify new, successful trader wallets (created within 30 days) and replicated their trades—a method less saturated than following public copy traders.

8. What kind of prompts work best with crypto AI?

Effective prompts are specific and data-oriented, such as:

-

“Find tokens with abnormal volume on BSC, filtered by liquidity and top wallet concentration.”

-

“Show top buyers of [Token] and analyze smart money movements over the last 48 hours.”

-

“Provide deep on-chain analytics for [Token] including holder balances and exchange flows.”